When a Firm Practices Perfect Price Discrimination

Trade restrictions such as duties taxes and quotas would increase the price of the product and the firm fixes a higher price to recover the taxes and duties. In this consumers fail to enjoy any consumer surplus.

Department of Agricultures Conservation.

. Feature of perfect competition. It describes the highest possible level of price discrimination which is why its sometimes also referred to as perfect price discrimination. It amends the 1914 Clayton Antitrust Act.

Assume this restaurant knows each. A Very large no. Tax Filing Changes You Should Know for Your 2021 Taxes.

Shoosmiths LLP The Legal 500 Rankings Dispute resolution Debt recovery Tier 1 During 2021 Shoosmiths LLP teamed up with national collections recoveries and enforcement company Chartsbridge to create a new debt recovery joint venture Equivo which aims to provide a one-stop shop multi-disciplinary recoveries service for clients operating from bases in London. A firm can takes the decision regarding the output only. Department of Agriculture National Agricultural Library.

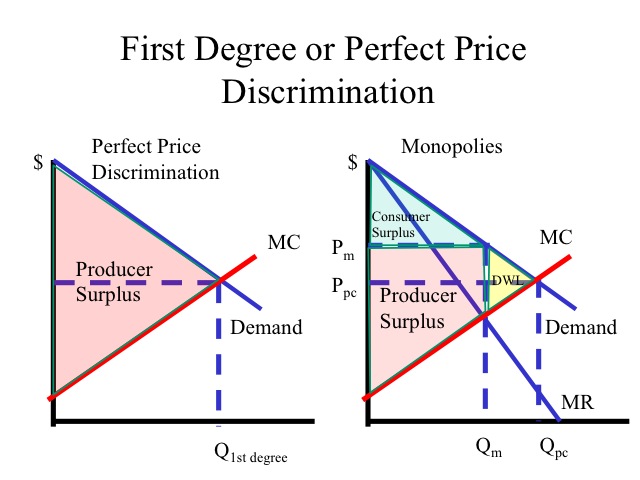

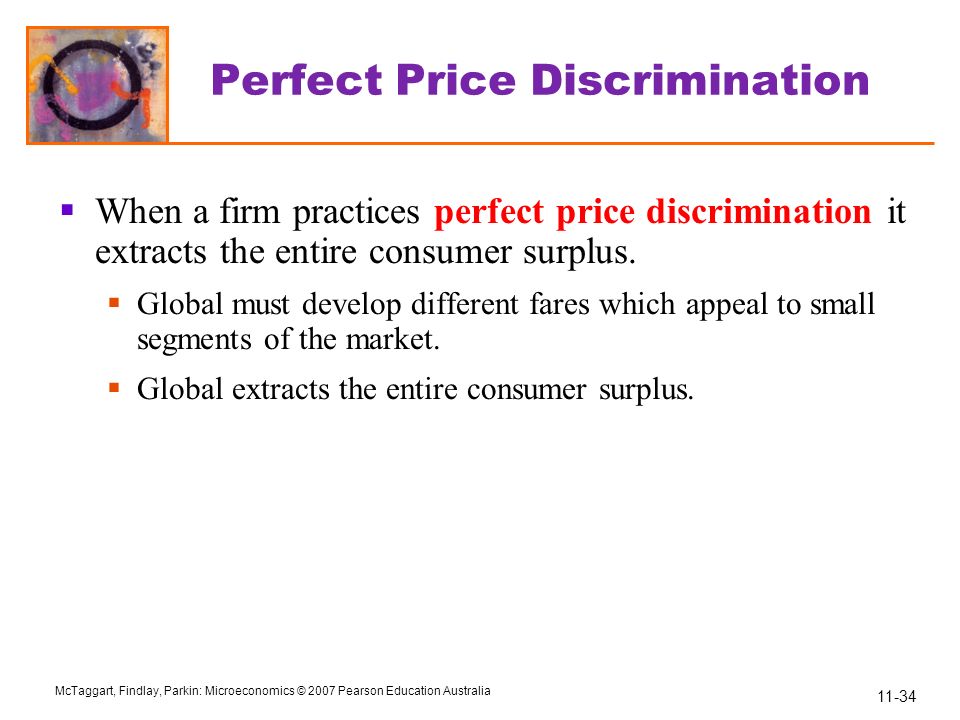

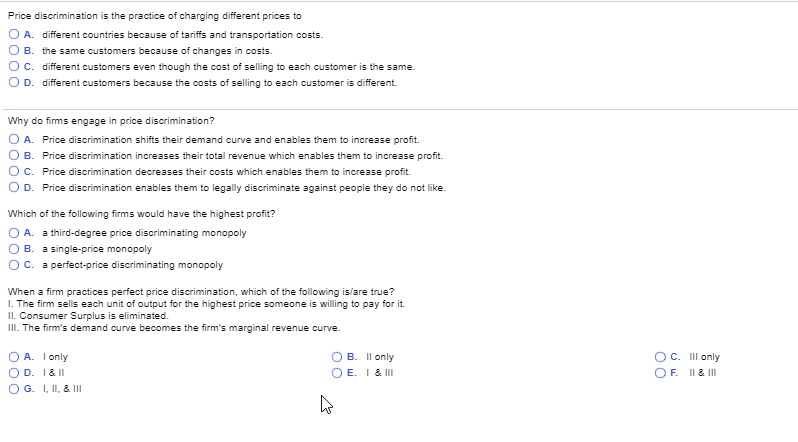

No individual firm can influence the price of the product. First degree or perfect price discrimination is when a firm charges each consumer their maximum willingness to pay which is reflected by the demand curve. Why April is the Perfect Time to Switch to FreshBooks.

This is also known as perfect price discrimination as it involves maximum exploitation of consumers. Twitter adopts a poison pill to thwart Elon Musks 43B takeover giving shareholders time to purchase additional shares at a discount to dilute 15 stakes Twitters board on Friday enacted a defensive measure meant to deter Elon Musks 43 billion hostile takeover bid. It amends the 1914 Clayton Antitrust Act.

From stock market news to jobs and real estate it can all be found here. There was only a scattering of diehard opposition typified by restaurant owner. First degree is practiced by lawyers and doctors.

Cumulative Collusive Excess Cover. At the completion of the review in July 2016 the firm issued a written report summarizing its. Under perfect competition price is determined by the industry on the basis of market forces of demand and supply.

Cumulative collusive excess cover. A reinsurance contract in which losses over a predetermined limit are shared between the cedent and the reinsurance company. Reviews of the State of the Art and Research Needs Special Reference Brief 2004-04.

As in other cases it is optimal for the firm to choose its output at the point where MRMC. When the required information is available the firm can maximize profits and eliminate all consumer surplus. Furthermore racial religious and gender discrimination was outlawed for businesses with 25 or more employees as well as apartment houses.

20 Accounting and Bookkeeping Organizations and Associations Worth Joining. Acting entirely independently Winston reviewed the FCRL Divisions policies procedures and practices and recommended changes to ensure that such policies procedures and practices conform to the highest professional and ethical standards and best litigation practices. The firm can fix a low selling price.

To illustrate this lets look at an imaginary restaurant called Deli Pizza. So industry is price maker and firm is price taker. This bibliography is one in a multi-volume set developed by the Water Quality Information Center at the National Agricultural Library in support of the US.

Practices and Related Issues. Absent price discrimination the Agency will delineate the product market to be a product or group of products such that a hypothetical profit-maximizing firm that was the only present and future seller of those products monopolist likely would impose at least a small but significant and nontransitory increase in price. That is assuming that buyers likely would.

5 Important Things to Do After Tax Season for Accountants. The Robinson-Patman Act is a federal law passed in 1936 to outlaw price discrimination. The South resisted until the last moment but as soon as the new law was signed by President Johnson on July 2 1964 it was widely accepted across the nation.

Refers to a price discrimination in which buyers are divided into different groups and different prices are charged from these. But if a firm can charge each person hisher maximum willingness to pay then MR price as found on the demand curve. If the firm expects higher price per unit of the product they may charge a higher price for the product.

Get breaking Finance news and the latest business articles from AOL. With the Right Tax Reports Keep All Your Numbers in One Place During Tax Season. Of buyers and sellers.

Chapter 11 Monopoly Ppt Download

Solved Price Discrimination Is The Practice Of Charging Chegg Com

Solved If A Firm Practices Perfect Or First Degree Price Chegg Com

Comments

Post a Comment